Rupesh Ganpat, a 31-year-old prospective businessman, has set his sights on bridging the financial literacy gap among Guyanese citizens.

He believes that a significant portion of the population lacks a fundamental understanding of Guyana’s financial system.

He is determined to be part of the solution by educating his fellow Guyanese about financial literacy and how they can efficiently use their finances.

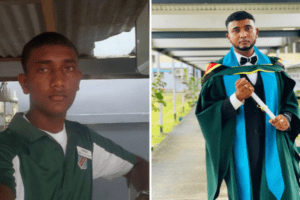

Ganpat, who is the eldest of three siblings, shared that his journey began with humble roots. His parents frequently relocated during his formative years but eventually settled in Leonora in 1998.

He attended Leonora Primary School and, after excelling in the National Grade Six Assessment (NGSA), secured a place at Bishops’ High School.

However, he narrowly missed admission to Queens College by just one mark, a moment he remembers up to this day.

Ganpat’s journey to adulthood was far from easy. He fondly remembers the sacrifices his parents made to ensure that he and his siblings received an education.

I remember I couldn’t afford textbooks for secondary school, and I ended up using the National Library and the school library. I shared textbooks with friends who had access to them. I did not have the chance to type my SBAs as I didn’t own a computer or have access to any.

Growing up being the first in the family to attend a ‘town’ school was hard. I didn’t have anyone to show me ropes or lean on. I didn’t have a role model. I made mistakes along the way, and I learned from it. I am grateful to my parents.

The 31-year-old relayed that his dream was to become an electrical engineer, but due to financial constraints coupled with the lack of know-how, he did not pursue this field at the University of Guyana.

Nonetheless, Ganpat accomplished an impressive academic record, obtaining 13 subjects at the Caribbean Secondary Education Certificate (CSEC) and three subjects at the Caribbean Advanced Proficiency Examination (CAPE).

Rupesh Ganpat graduated from the University of Guyana with a Diploma in Banking and Finance

He also holds a Diploma in Banking and Finance, a Bachelor’s Degree in Finance, and an MBA in Project Management from the European Institute of Leadership and Management.

Upon completing high school, Ganpat submitted numerous job applications. In 2010, a friend encouraged him to apply at UNICOM, which was located at the Guyana National Shipping Compound in La Penitence, Georgetown.

After a few months on the job, the former Bishops’ High School student secured a position at the Guyana Bank for Trade and Industry (GBTI) as a Night Safe Assistant.

He spent a decade at GBTI, leaving the company in 2020 with the role of Commercial Loan Officer. Following a brief stint with Massy Distribution, he assumed the role of Mahaica Branch Manager at Diamond Fire and General Insurance Inc.

Even though I had no prior knowledge of the insurance industry, I took up the challenge and excelled. I spent a lot of time reading and networking and put my knowledge to use. My Branch is currently the most successful branch at DFGI.

With his expertise, Ganpat has a genuine desire to help people manage their finances efficiently and how they can make efficient use of it. As a result, he is preparing to launch his own consultancy firm in mid-2024.

I think finance should be taught at an early level in schools. The Ministry of Education should make Principles of Business compulsory in all secondary schools. It would really help our young ones. I think most Guyanese are not educated about our financial system.

For example, most of us would go to Courts to buy an item that has a 30%-36% interest rate hire purchase instead of going to the Bank and taking a loan at a 12%-14% interest rate. You can even lodge your savings and take a short-term loan to purchase an item. There are so many ways in which you can save your earned cash and invest it.

Currently, the 31-year-old is pursuing a Master’s in Procurement Management at the University of Guyana, and he anticipates that his extensive knowledge in the finance sector will open doors to exciting opportunities within the oil and gas industry.

His financial tip to our readers is “to understand cash flow is better, and profits for the business people and for individuals would be to work out the budget formula. For example, 25:25:25:25 (25% savings, 25% expenses, 25% investment, 25% personal). Of course, this can be adjusted to suit you,” he concluded.

Whether you need assistance with your finances or insurance, contact Ganpat on telephone number +592 652-0436.